- Good reads \

- How to Create a Solar Project in Your Community, Part 2

How to Create a Solar Project in Your Community, Part 2

Dec 12, 2020The project creation journey continues! By this time you’ve thought about your motivation for starting a project, decided on the type of project you are creating, established an idea of the way your team, project company, and holding company interact, and established site control with your project location.

Costs

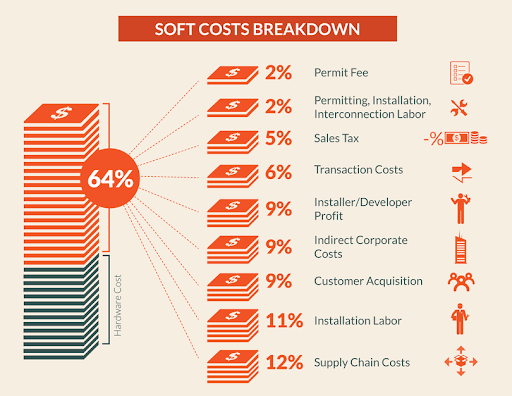

Now you’re ready to quantify the costs and earnings of your project, build out a financial model and bring you towards raising the money. Most projects have myriad costs in addition to the actual cost of the equipment (panels, racking, inverters). These additional costs include legal, permitting, operations and maintenance, etc. They’re often referred to as soft costs, and they make up about 64% of the project cost on average according to PV Magazine. Part of the value that Raise Green provides as a financing partner is to help you reduce your soft costs. Calculating what your additional costs will be to get your project done is an important step in understanding whether your project will be profitable financially. You will need to itemize these costs in your use of proceeds so that the crowd knows how you’re going to spend their money.

Off-taker

The biggest single driver of the financial viability of your project is the price that you get for selling the electricity that your project generates. That’s why the next step is finding an offtaker for your solar project -- someone who buys the electricity you generate. This could be secured through an agreement from one off-taker, or from many off-takers where community solar is allowed. The standard agreement is called a Power Purchase Agreement (PPA), and it is the bread and butter of solar project finance - a source of revenue that provides contracted cash flows and drives revenue for you and your project’s crowd investors. In your PPA, off-takers generally agree to a fixed cost of electricity purchase over a long time period of approximately 15-25 years. Raise Green helps simplify this process with the generation of a PPA unique to the variables you enter into our Originator Engine.

Financials

As an Originator, earning money for your hard work is crucial. With Raise Green, you can input data unique to your project and we will run a financial model that helps estimate the costs and allows us to conduct due diligence on the financial viability of your project, including your potential Originator earnings. The rest of your forecasted project earnings may be re-payed back to your investors, depending on the way you structure your investment opportunity on our marketplace. It's important to remember that raising money for a project isn’t a get rich quick scheme, you’re building a real infrastructure asset that provides essential services. Monitoring and maintaining your project is a decades-long process as long as the PPA is in effect and your system continues to generate electricity. That’s why it's extra important to have a good team and partners to make a plan for asset management that will see it through for the long haul.

Partners

Luckily, you don’t have to do it all yourself, there are enterprise partners standing by to help from start to finish on these services and more: banking, insurance, accounting, legal, tax equity, solar installer/engineering, procurement and construction (EPC). All of these partners play a key role in your project and we’re glad to refer you to some folks so you can establish these relationships prior to the listing and sale of securities on Raise Green’s marketplace. If you have all of these partners so far, or if you know how to establish these partnerships and are up for the task, good for you! Keep on moving forward and get ready for your raise. For some others, you might have only gotten so far and realized that you need extra help, either in the form of a team or capital, or you might just want to unload your project. If this describes you, get in contact with us as we may be able to help in the form of developing your project or listing a development capital raise (more info coming soon!).

Marketing

One of the final things to do before listing your project is to come up with the story and start thinking of marketing to your network. By story, we mean the information about your project that will be listed on our marketplace that will be shared with investors. If you’ve made it this far, you’ve passed our R.A.I.S.E. due diligence and put in a lot of time, so feel free to take advantage of it by sharing some of your success story and motivation. This is the place where you mention the beneficial community, environmental, and potential economic benefits that come about from putting your project on the ground. Once it's listed, Raise Green will share it with our network, but it's also on you to contact supporters within your own community network to spread the word and hopefully drive investment interest in your project!

That concludes the sneak peek into life as a Raise Green Originator. If you have most of the resources and decisions above ready, then you are a perfect candidate to move through our Originator Engine to generate your project. If you find yourself lacking in a couple things here and there, it would be a great idea to reach out to our Head of Originator Sales, Jackie Logan, to share your project idea in a 15 minute meeting and see where Raise Green can provide guidance to fill in the gaps!

As always, feel free to engage us in conversation and send any questions or comments you might have to info@raisegreen.com.

To get the most up-to-date information on Raise Green content, please sign up for our email list and follow any of our social accounts (Instagram, Twitter, Facebook, LinkedIn).

This Blog is for discussion purposes only, expresses the views of Raise Green, and is not investment research. This is not investment or tax advice, and does not constitute a solicitation to sell or an offer to buy any securities. Certain information is from or links are to third party sources. Although they are believed to be reliable, we do not guarantee their accuracy, completeness or fairness. Raise Green is a licensed Funding Portal with the SEC and FINRA, and is not a Municipal Advisor. Prior to being approved to list a company on the Raise Green portal, a diligence review is completed. Prior to investing. investors must sign up for an account on the portal. Raise Green does not provide tax, accounting or legal advice. Investing in crowdfunded offerings involves risk and you should review the risks of a particular investment prior to investing. You are strongly encouraged to consult your professional advisors before investing. Go to www.raisegreen.com for additional information on services, the funding portal, regulation, and investment risks. Or, direct inquiries to info@raisegreen.com. Copyright © 2021