- Good reads \

- The Long Road to Solar Tax Credits: Making Tax Equity Accessible

The Long Road to Solar Tax Credits: Making Tax Equity Accessible

Jan 26, 2021You may have heard of solar and other clean energy tax credits, as they’ve been a prominent incentive driving investment in U.S. clean energy. In fact, according to the Solar Energy Industries Association, since the Investment Tax Credit was enacted back in 2006, the solar industry in the U.S. has grown by a whopping 10,000%. And thanks to a recent policy extension, solar project developers are allowed to deduct 26% of project costs from their federal taxes for projects in 2021 and 2022, a continuation of this policy that drives significant growth and can make new projects feasible.

The catch is that solar tax credits are mostly claimed by a small set of wealthy players and investment bankers, who have segmented the benefits into a tax equity market:

“Tax equity is an investment category that has arisen thanks to tax credit policies, where a third party totally unrelated to the project itself provides some of the project capital simply to harvest the tax benefits.” - Rob Day, Forbes.

Since the tax equity market is made up of a concentrated group of large investors, it's often difficult for smaller scale projects to benefit from it. Smaller solar projects can be just as feasible when they’re able to capture the tax credit, but they’re often overlooked because they inevitably have less gross profit than larger projects. Economic uncertainty from COVID-19 has further increased the reluctance of tax equity investors.

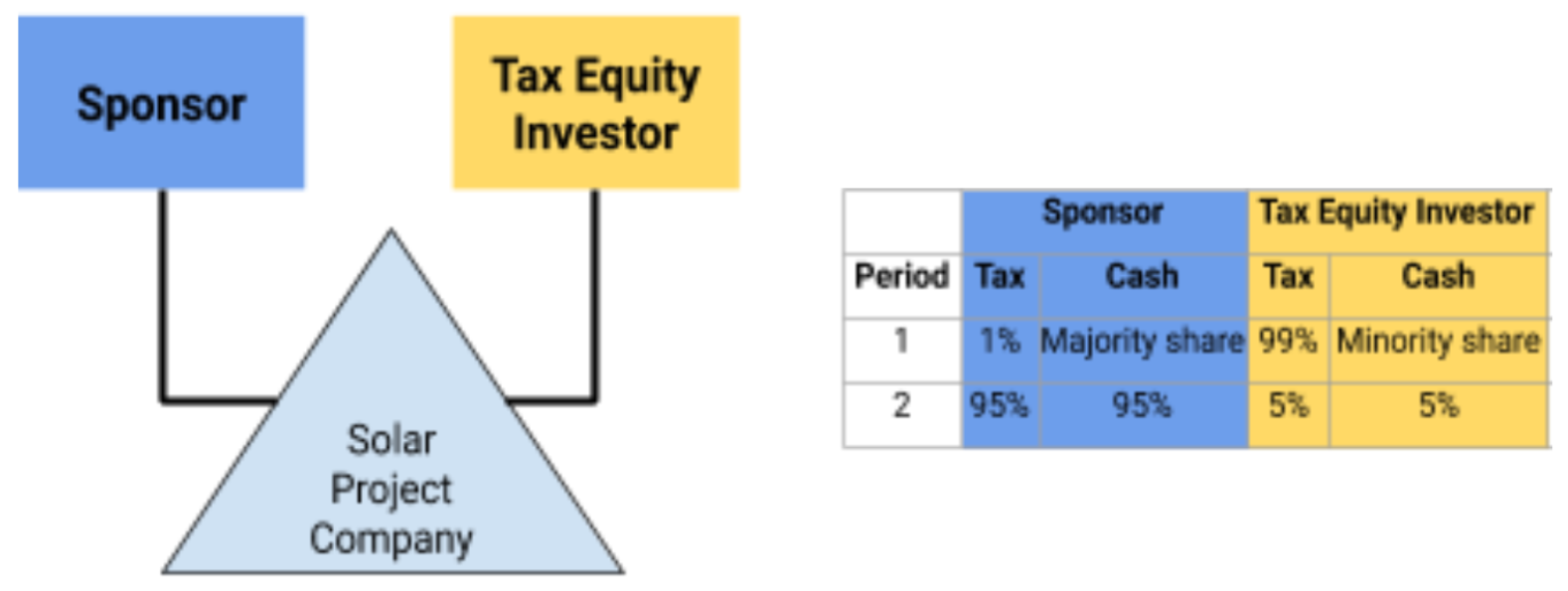

We don’t think wealthy investment bankers should have the final say, which is why Raise Green is innovating in an area called a “tax equity partnership flip.” We help connect solar project owners (“Sponsors”) with our dedicated mission-driven tax equity investors, who are standing by to help partner with community project developers and monetize the federal tax benefits. Once they harness these savings, majority ownership of the solar project flips back to the Sponsor.

This isn’t just a theory. Our Founders actually conducted one of the smallest tax-equity partnership flips in U.S. history on a community-scale solar project in New Haven, Connecticut back in 2019.

Without getting too deep into solar project finance, Raise Green essentially helps create local ownership! Rather than being bound to a bank for the entire term of the project, ownership ultimately stays within the community, while still benefiting from tax equity savings.

It seems silly that project owners have to complicate their financing around an additional outside investor, in order to qualify for a policy that’s supposed to make the projects more accessible. This is why we’ve helped develop and recommend a variety of proposed solutions, including making incentives available simply as direct payments like the 1603 cash-grant program under the 2009 Recovery Act, or instituting a refundable tax credit. But until Congress takes action to change the law, Raise Green is here to help navigate the tax equity market and unlock access for communities and small businesses!

If you’re interested in starting your own clean energy project, Raise Green can support both the development (Originator Engine) and funding (Marketplace). Or if you’re interested in investing in an existing project, you can create an investor account for free here.

As always, feel free to send any questions or comments you might have to info@raisegreen.com.

To get the most up-to-date information on Raise Green content, please sign up for our email list and follow any of our social accounts (Instagram, Twitter, Facebook, LinkedIn).

This Blog is for discussion purposes only, expresses the views of Raise Green, and is not investment research. This is not investment or tax advice, and does not constitute a solicitation to sell or an offer to buy any securities. Certain information is from or links are to third party sources. Although they are believed to be reliable, we do not guarantee their accuracy, completeness or fairness. Raise Green is a licensed Funding Portal with the SEC and FINRA, and is not a Municipal Advisor. Prior to being approved to list a company on the Raise Green portal, a diligence review is completed. Prior to investing. investors must sign up for an account on the portal. Raise Green does not provide tax, accounting or legal advice. Investing in crowdfunded offerings involves risk and you should review the risks of a particular investment prior to investing. You are strongly encouraged to consult your professional advisors before investing. Go to www.raisegreen.com for additional information on services, the funding portal, regulation, and investment risks. Or, direct inquiries to info@raisegreen.com. Copyright © 2021

This Blog is for discussion purposes only, expresses the views of Raise Green, and is not investment research. This is not investment or tax advice, and does not constitute a solicitation to sell or an offer to buy any securities. Certain information is from or links are to third party sources. Although they are believed to be reliable, we do not guarantee their accuracy, completeness or fairness. Raise Green is a licensed Funding Portal with the SEC and FINRA, and is not a Municipal Advisor. Prior to being approved to list a company on the Raise Green portal, a diligence review is completed. Prior to investing. investors must sign up for an account on the portal. Raise Green does not provide tax, accounting or legal advice. Investing in crowdfunded offerings involves risk and you should review the risks of a particular investment prior to investing. You are strongly encouraged to consult your professional advisors before investing. Go to www.raisegreen.com for additional information on services, the funding portal, regulation, and investment risks. Or, direct inquiries to info@raisegreen.com. Copyright © 2021