- Good reads \

- Build Back Better With More Solar Development

Build Back Better With More Solar Development

Sep 24, 2021Potential Changes to Solar Investment Tax Credits and Direct Pay Provisions

The solar industry has averaged 42% growth annually over the last decade according to the Solar Energy Industry Association, showcasing the imminent need for renewable and affordable energy1. In America, the solar industry employs nearly 250,000 and has eclipsed $25B in value2. As the globe’s total greenhouse gas emissions continue to rise, solar offers a pathway to a decarbonized energy system, with added environmental resilience, consumer affordability and reliability to boot. However, policy changes within the United States threaten continued expansive solar development.

In this blog, we break down what this means for project developers, what avenues for funding can become more influential, and what to think about when starting a solar energy project.

Solar Investment Tax Credit

Perhaps the most impactful policy when it comes to solar development in the United States is the solar Investment Tax Credit (ITC). The solar ITC is responsible for the 12,000% growth in the solar industry since 2006, when it was enacted to spur solar innovation and encourage widespread adoption3. This provision has created tens of thousands of jobs, funneled billions of dollars into the US economy, and has allowed solar to stake a legitimate claim in US energy markets. There are now four states (California, Massachusetts, Vermont, and Hawaii) that generate over one-fifth of their total power production from solar systems4.

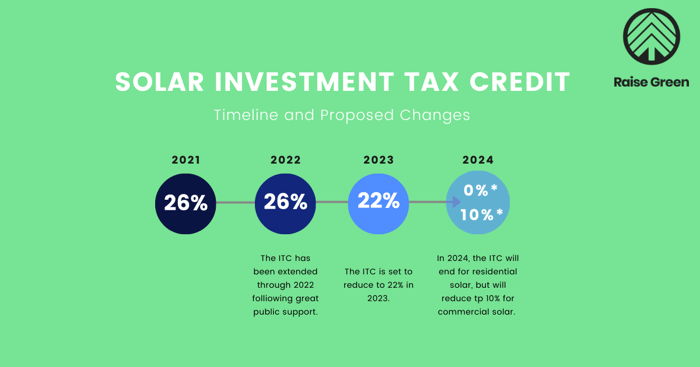

The ITC is currently a 26% tax credit that can be applied to solar systems on residential (through Section 25D) and commercial (through Section 48) projects. Through Section 48, the commercial credit can be applied to both utility-scale solar farms and customer-sited solar installations. Through the residential ITC, homeowners apply the credit to their personal income taxes, whereas under the commercial ITC, the business responsible for development, installation, or financing claims the tax credit5. Tax credits afford the person or company that claims them a dollar-for-dollar reduction in taxes owed to the federal government. In 2020, Congress delayed the reduction of the ITC, preventing it from lowering to 22%. However, without further extension, the ITC will reduce and all but disappear by 2024. This means that solar developers with access to potential project sites must act quickly to benefit from the ITC.

In the American Jobs Plan, there is currently a proposed expansion of the ITC through 2033. This would raise the ITC to a 30% credit, with a 6% base value, expanding to 33% if domestic materials and content are utilized6. The newly proposed ITC could be used for a myriad of solar technologies, beyond just PV installations:

- Energy Storage technologies (with a minimum capacity of 5 kWh)

- Linear generations (with a minimum capacity of 1 kWh)

- Microgrid controllers (used to manage energy resources and loads in standalone/independent grid systems)

- Dynamic glass (used in energy efficient buildings to prevent converse thermal heating)

- Biogas properties (which convert biomass into a gas that is no greater than 52% methane and can be used productively)

The expansion of the ITC could allow for continued high-growth of the American solar industry, create job opportunities across the nation, and help commit our country to a decarbonized future.

Direct Pay Provision

The Direct Pay Provision outlined in President Joe Biden’s full Build Back Better agenda, a sweeping infrastructure proposal, could be the most impactful change to the solar industry since the introduction of the ITC. The Direct Pay provision, should it pass in its current form, would create an avenue for solar project developers and owners to receive direct pay equivalent to the ITC from the federal government, instead of leveraging the ITC as an offset against taxes owed. This would eliminate the often painstaking process of structuring tax equity financing and finding a suitable tax partner that has sufficient passive income to monetize the credit. Missing from the Direct Pay Provision in the infrastructure bill is Section 25D, meaning that direct pay will not be available for residential projects. While Raise Green believes that homeowners should benefit from this policy, we believe that its introduction into the commercial sector (under Section 48) is a much-needed step in reducing the barriers to solar development.

While it remains to be seen if the new ITC and Direct Pay Provision will survive the legislative process this fall, their approval could act as a keystone for the continued expansion of solar energy in America.

Citations

1. Solar Energy Industries Association. (2021). Solar industry research data. Retrieved September 21, 2021, from https://www.seia.org/solar-industry-research-data.

2. Ibid.

3. IEA. (2019, September 13). United States - countries & regions. IEA. Retrieved September 21, 2021, from https://www.iea.org/countries/united-states.

4. Solar Energy Industries Association. (2021). Solar State by State. Retrieved September 21, 2021, from https://www.seia.org/states-map.

5. House Ways and Means Committee. (2021, September 10). Budget Reconciliation Bill. Retrieved September 21, 2021, from https://waysandmeans.house.gov/sites/democrats.waysandmeans.house.gov/files/documents/SUBFGHJ_xml.pdf.

6. Ibid.

Stay in the Know

Have any questions for us? Email us at info@raisegreen.com or check out our FAQ page. To get the most up-to-date information on Raise Green content, please sign up for our email list and follow any of our social accounts (Instagram, Twitter, Facebook, LinkedIn).

This Blog is for discussion purposes only, expresses the views of Raise Green, and is not investment research. This is not investment or tax advice, and does not constitute a solicitation to sell or an offer to buy any securities. Certain information is from or links are to third party sources. Although they are believed to be reliable, we do not guarantee their accuracy, completeness or fairness. Raise Green is a registered Funding Portal with the SEC and a FINRA member, and is not a Municipal Advisor. Prior to being approved to list a company on the Raise Green portal, a diligence review is completed. Prior to investing. investors must sign up for an account on the portal. Raise Green does not provide tax, accounting or legal advice. Investing in crowdfunded offerings involves risk and you should review the risks of a particular investment prior to investing. You are strongly encouraged to consult your professional advisors before investing. Go to www.raisegreen.com for additional information on services, the funding portal, regulation, and investment risks. Or, direct inquiries to info@raisegreen.com. Copyright © 2021.

This Blog is for discussion purposes only, expresses the views of Raise Green, and is not investment research. This is not investment or tax advice, and does not constitute a solicitation to sell or an offer to buy any securities. Certain information is from or links are to third party sources. Although they are believed to be reliable, we do not guarantee their accuracy, completeness or fairness. Raise Green is a licensed Funding Portal with the SEC and FINRA, and is not a Municipal Advisor. Prior to being approved to list a company on the Raise Green portal, a diligence review is completed. Prior to investing. investors must sign up for an account on the portal. Raise Green does not provide tax, accounting or legal advice. Investing in crowdfunded offerings involves risk and you should review the risks of a particular investment prior to investing. You are strongly encouraged to consult your professional advisors before investing. Go to www.raisegreen.com for additional information on services, the funding portal, regulation, and investment risks. Or, direct inquiries to info@raisegreen.com. Copyright © 2021