What are ESG Metrics?

The use of impact metrics is skyrocketing as impact-based investing markets have quadrupled in size from 2016 to 2020 [2]. Despite rapid growth, there is still a misunderstanding of what impact metrics are and how accurately these metrics measure impact.

Impact metrics attempt to quantify a company’s impact on issues non-financial outcomes. Examples include carbon emissions, male-female ratio in the workplace, and number of controversies surrounding a company.

Impact metrics aim to paint a picture that financial metrics cannot, showing the full scope of a company’s social and environmental footprint. It’s easier to measure revenue or salaries, than gender diversity or persistent organic pollutants in a supply chain. As a result of that uncertainty, there are at many major metric frameworks with different impact metrics that try to quantify this footprint. The number of different impact funds, investment banks, non-profits, philanthropies, and family offices that construct their own metrics and frameworks only adds to the confusion.

“ESG'' is the hottest phrase in finance. It’s really more a philosophy than an accounting methodology. It’s derived impact metrics are simplified into three categories: Environmental, Social, and Governance. They were first introduced in the 1960s and inflow into ESG-based funds reached $71.1 billion in the second quarter of 2020 [2]. A positive correlation exists between higher ESG rating and increased financial performance (Eccles et al. 2014, Khan et al. 2015, Friede et al. 2015), which makes sense due to an ESG score encompassing management quality and practices. Overall, ESG metrics seem to have had a positive impact on investing, allowing people to better quantify a company’s impact.

How to standardize thousands of impact metrics?

However, as we see more and more companies calculating ESGs, there is now an emerging problem of how to standardize all this data.

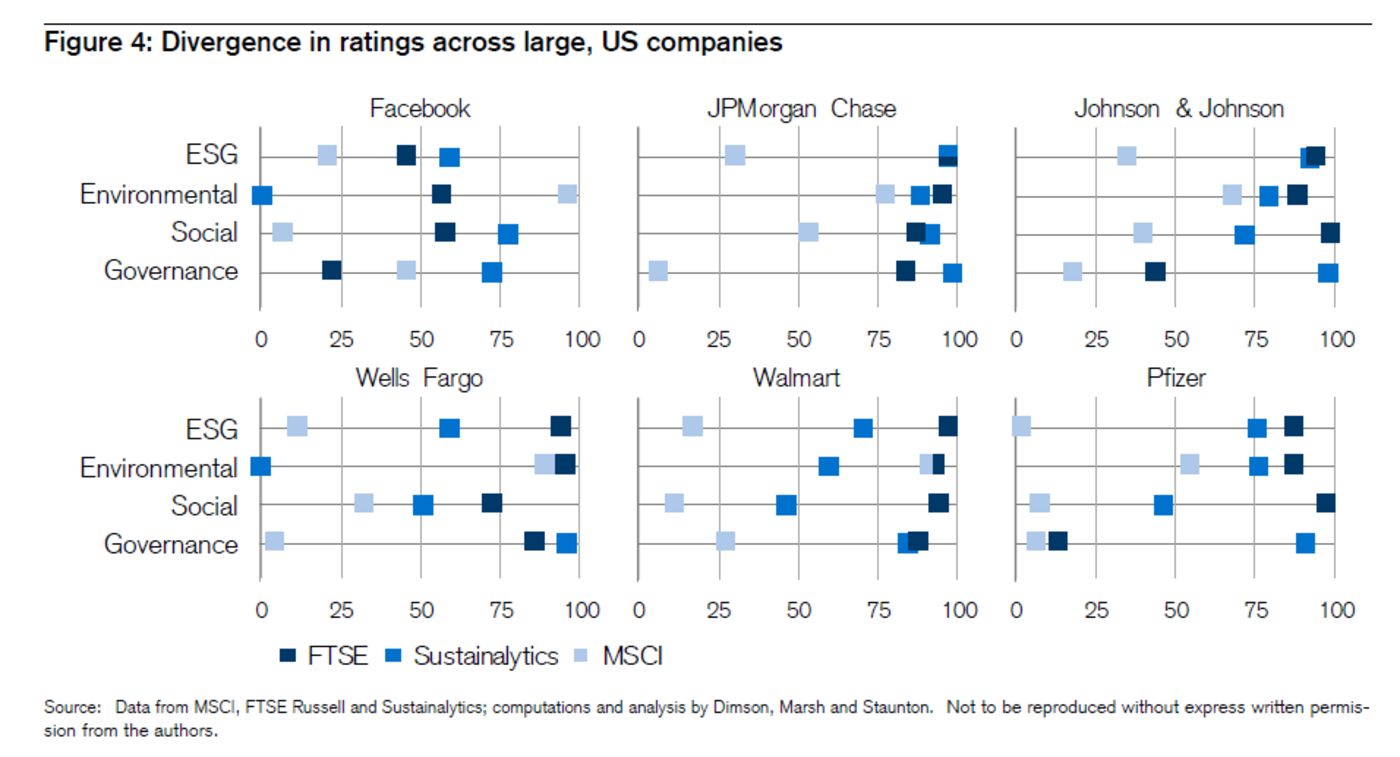

Many different organizations calculate ESG to provide better insight -- an “edge” -- to their investing (e.g. Bloomberg, Dow Jones, MSCI, and Sustainalytics). While these companies aim to provide similar insights, there is large variation between how each calculates this metric. For example, in the figure below we can see three ESG scores for three different companies.

Figure 1. ESG Metric Variance in Public Companies. Widely dispersed rankings of the same companies indicate a lack of confidence for investors seeking impact outcomes (https://www.bloomberg.com/opinion/articles/2020-05-21/esg-investing-s-good-coronavirus-crisis-is-killing-jobs)

The variation between scores in this image is concerning. The issue here is a lack of standardization in how ESGs are calculated which must be addressed, but how?

Moving towards standardization

ESG Data Standards are proposed in a paper by Cort and Esty [1] and suggest ESG metrics be held to three standards:

- Methodological standards - require that all ESG data be accurate, complete, and timely. To make sure that all data meets these requirements, it should be verified by either government regulatory standards, third-party auditing, or some data vendor (MSCI, Bloomberg, etc.)

- Materiality-based - standards address the need for compatibility between company’s ESG scores, and as we saw from figure 1, there is little to no commonality in ESG metrics between companies we saw in figure 1, there is little to no commonality in ESG metrics between companies. This standard would require companies to calculate ESG scores on a consistent list of metrics and management processes using common methodological practices.

- Impact data standards - focus on generating comparable data on externalized social and environmental impacts. Through normalizing what makes up ESG scores, we can create a better picture of whether a company is a net benefit or detriment to society.

What’s next?

The current growth in sustainable investing has outgrown current ESG capabilities. For investors to continue to rely on impact metrics, these standards must be implemented through cooperation and regulation. At Raise Green, we hope that these standards allow an accurate portrayal of a company’s true financial footprint.

This Blog is for discussion purposes only, expresses the views of Raise Green, and is not investment research. This is not investment or tax advice, and does not constitute a solicitation to sell or an offer to buy any securities. Certain information is from or links are to third party sources. Although they are believed to be reliable, we do not guarantee their accuracy, completeness or fairness. Raise Green is a licensed Funding Portal with the SEC and FINRA, and is not a Municipal Advisor. Prior to being approved to list a company on the Raise Green portal, a diligence review is completed. Prior to investing. investors must sign up for an account on the portal. Raise Green does not provide tax, accounting or legal advice. Investing in crowdfunded offerings involves risk and you should review the risks of a particular investment prior to investing. You are strongly encouraged to consult your professional advisors before investing. Go to www.raisegreen.com for additional information on services, the funding portal, regulation, and investment risks. Or, direct inquiries to info@raisegreen.com. Copyright © 2021

This Blog is for discussion purposes only, expresses the views of Raise Green, and is not investment research. This is not investment or tax advice, and does not constitute a solicitation to sell or an offer to buy any securities. Certain information is from or links are to third party sources. Although they are believed to be reliable, we do not guarantee their accuracy, completeness or fairness. Raise Green is a licensed Funding Portal with the SEC and FINRA, and is not a Municipal Advisor. Prior to being approved to list a company on the Raise Green portal, a diligence review is completed. Prior to investing. investors must sign up for an account on the portal. Raise Green does not provide tax, accounting or legal advice. Investing in crowdfunded offerings involves risk and you should review the risks of a particular investment prior to investing. You are strongly encouraged to consult your professional advisors before investing. Go to www.raisegreen.com for additional information on services, the funding portal, regulation, and investment risks. Or, direct inquiries to info@raisegreen.com. Copyright © 2021